The Business of writing

About us

Writing is undoubtedly a creative art. Whether we are working on the next Booker Prize winner or ghostwriting blog posts, writers need to be original, imaginative and inspired. But writing is also a business, with invoices to raise, accounts to be submitted and records to be kept. Writers, like artists, can find themselves floundering when it comes to the ‘business end’ of the job. Read on for our easy-to-follow guide to the business of writing...

Writing is undoubtedly a creative art. Whether we are working on the next Booker Prize winner or ghostwriting blog posts, writers need to be original, imaginative and inspired. But writing is also a business, with invoices to raise, accounts to be submitted and records to be kept. Writers, like artists, can find themselves floundering when it comes to the ‘business end’ of the job. Read on for our easy-to-follow guide to the business of writing...

Keeping Track

One of the most important aspects of running any business is to keep good records. You don’t have to be an expert on spreadsheets to do this but it does help if you know your way around a programme like Microsoft Excel. There are many free guides on the web – test out your researching skills by doing a Google search to find one.

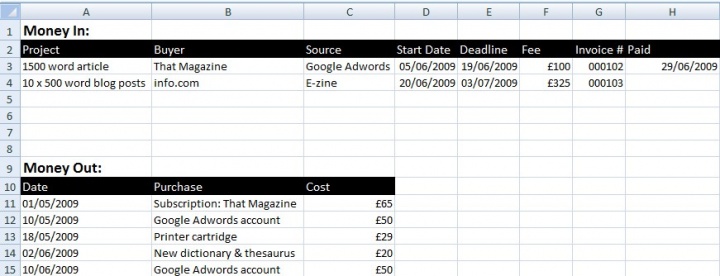

Whether you keep your records manually or electronically, the same rules apply. Keeping track of each job – start and target completion dates, invoice number, payment received (or not) – and details of each client (agent, publisher, magazine etc) is key. It is also useful to keep a record of where the work came from – which particular advert or marketing exercise is working most successfully? Most importantly, you need to keep track of any expenses you incur – from buying paper and stationery, to postage, training courses, subscriptions, travelling costs, equipment – anything, indeed, which is directly needed for your business. Always ask for – and keep – receipts.

This example is simple but straightforward, and can be adapted to suit your individual needs:

Update your records at least once a week, and if using a spreadsheet remember to print out a hard copy.

Invoicing Tips

Many writers are dismayed the first time they are asked to ‘invoice’ for their work. What is an invoice, anyway? Why can’t you just ask for payment? It’s all to do with the paper-trail which keeps accountants (and the taxman) happy – more on this later. The company or individual you produced the piece of writing for needs an invoice to show where that particular amount of money went – i.e. to you.

The invoice needs only to include your name and address (and business name, if you have one); the date and any job or reference number you have been given; the amount you are expecting to be paid and a brief description of the work completed, e.g. Article, 1000 words, The Business of Writing. You can also include details of how you would like to be paid (by cheque within 30 days, for example). It is always a nice touch to end the invoice by thanking your client for their business.

Taxing Matters: Tax in the UK

Tax is a thorny subject for most of us, often because it remains a mysterious art-form, understood only by costly accountants and faceless officialsat HM Revenue and Customs (HMRC). In actual fact, tax is relatively simple, and recent efforts by HMRC have made the whole process a lot more accessible and user-friendly. I’m talking, of course, about self-assessment. But, before we get ahead of ourselves, back to basics...

As a self-employed writer (a loose definition of self-employed is that you carry out paid work for more than one client) you are required to register yourself with HMRC within three months of starting a business.This can be done online, over the phone or by filling in a downloadable form. See this link for more information:

http://www.hmrc.gov.uk/startingup/index.htm

Once you have registered as self-employed you will be sent a self-assessment tax return, to be completed in time for the next tax year. There are many helpful leaflets and articles on the HMRC’s website – if you are new to self-assessment it is worth devoting some time to familiarizing yourself with the jargon. Don’t be overwhelmed – it really is very easy to understand.

Don’t panic when it’s time to fill out your tax return: this is where your fantastic records will be invaluable. If your turnover for the tax year is less than £15,000 you only need to submit three-line accounts. (Turnover is the amount you have invoiced, not your profit.) Three-line accounts are very simple and consist of turnover, expenses and profit. If your turnover is over this threshold you will need to give more detailed accounts. If you have kept good records this will be a breeze. The HMRC’s website allows you to fill out your self-assessment form online, and it holds your hand every step of the way. You can save it at any time, work out your tax liability, and only submit the return once you are completely happy with the figures.

If you aren’t computer-friendly (most writers in today’s marketplace should be), you can always take your records, receipts, and tax return to your local tax office, dump it all on their desk, and beg for help. They will help you – but next year they’ll expect you to have a go yourself!

National Insurance Matters Too

Don’t forget about your National Insurance obligation. As a self-employed person you are required to pay ‘voluntary’ contributions (Class 2), currently at £2.75 per week. The term voluntary is a misnomer – read up on National Insurance contributions here:

http://www.direct.gov.uk/en/MoneyTaxAndBenefits/Taxes/BeginnersGuideToTax/DG_4015904

You will also be liable to pay Class 4 National Insurance – these are a percentage of your taxable profits and are worked out along with your income tax liability.

Budgeting For Tax Payments

Many self-employed people advise putting away 25% of their earnings to ensure there is always enough in the pot to pay ‘the tax man’. This is possibly too steep a figure but it is better to be safe than sorry. There are heavy penalties for late payment – and very heavy penalties for non-payment, including prison. It is worth taking your tax and accounting issues fairly seriously.

Accountant Or Not?

If reading this article has brought you out in a sweat (not the excited kind), or if you haven’t read it and just skipped to the end, then you should probably get an accountant and send him or her your invoices and receipts once a month. You will need to factor your accountant’s costs into your budget, but if your turnover is large enough they may be able to save you money in the long run.

Warning: Ignorance Is No Excuse

Different rules apply for tax payments depending on your country of residence – and it is up to you to find out what they are. The taxman never accepts the excuse ‘I just didn’t know’. Wherever you live, however, the same general principles of running a successful business apply: keep thorough records; keep track of everything you buy or sell; be professional in all your dealings; and finally, find out what your obligations to the taxman are and make sure you fulfil them!

See also Joanne's new article The Business of Writing for Self-publishing Authors

Joanne lives in Cheshire, England with her teenage daughter. She writes and produces audio dramas as GravyTreeMedia, and romantic comedies, literary fiction and cozy mysteries as an indie author. An award-winning novelist, Joanne has a Masters in Creative Writing, and is a freelance publishing professional. Connect with Joanne at www.joannephillips.co.uk and on social media - she loves hearing from readers (and will probably send you some free stuff to say thank you).

Connect on:

Facebook: http://www.facebook.com/joannephillipsauthor

Twitter: @joannegphillips

Amazon: http://www.amazon.co.uk/Joanne-Phillips/e/B0083UEG86/

Other articles by Joanne on the WritersServices site:

How to Market Your Writing Services Online

She is also the author of The WritersServices Self-Publishing Guide, newly revised for 2024

Click here to start an online Order

See some of the Endorsements/Testimonials WritersServices has received from satisfied customers

Order Process Help

|

3 Payment |

We operate from the UK and under the financial rules and regulations of the UK